Since SodaStream’s November’10 IPO, several writers have highlighted the similarities between Green Mountain Coffee Roasters (GMCR) and SodaStream (SODA). Indeed, they have similar *business models, but I believe the two companies should be differentiated. Years ago, GMCR was a shining example of a socially ideal, yet profitable company with heavy emphasis on Corporate Social Responsibility (“CSR”). The firm was not only good to society and local community, but to its employees and investors as well. (* Both companies use the razor-razorblade business model.)

A decade ago, GMCR was a small, earthy-granola company with good (but not stellar) growth flying under the radar of larger heavyweights Now, GMCR itself is a big wig ($11Bn market cap) that is on the cusp of competing with some of the most well managed companies – think Starbuck’s, Dunkin Doughnuts.

Ah, before I get criticized for saying Starbuck’s is a competitor (as there’s a big contract with GMCR) I suggest readers take a closer look at that contract’s (lack of) details…Press Release

Background:

SodaStream International Ltd is an Israeli company that makes and sells home beverage machines. These portable machines typically make flavored sodas out of ordinary tap water, or just seltzer/sparkling water at the consumers’ preference. In order to make a flavored drink such as a cola, SodaStream sells these products:

- Soda Makers (Beverage Machines): to make the drinks

- CO2 refills: which make the drinks fizzy

- Flavored Syrups such as root beer, colas

- Bottles which the Soda Makers fill the soda into

SodaStream is not your grandfather’s Green Mtn. Coffee Roasters – it’s better than that! How then….?

Key Difference # 1

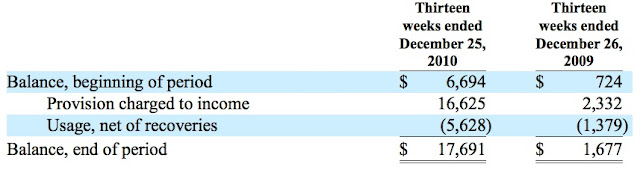

Harking back a decade ago, GMCR was showing real earnings – more recent earnings are suspect. It reported steady revenues and earnings growth, of which was organic (i.e., internal, without acquisitions). Now, I’m not quite sure what their earnings really are, or how rapidly the company is really growing given the huge acquisitions skewing reported growth. For additional information, please refer to this website’s article on Green Mountain, which essentially alludes to the company’s deceptive practices of presenting earnings.

By comparing GMCR’s pro-forma revenues to reported revenues, one realizes that the company is growing slower than it’s reporting, and that this is attributed to acquisitions. For example, during FY 1Q’11:

- Proforma Revenue growth (+54%) was below reported revenue growth (+67%). See table below for figures.

- Note: GMCR also focuses on Non-GAAP numbers when presenting to investors, of which excludes several items including cash litigation expenses. These Non-GAAP earnings are significantly higher than reported earnings.

The tables below present GMCR’s proforma condensed income statements for FY 1Q’11 and 2Q’11 (including YTD). The Securities and Exchange Commission’s Rule 210.11-02 requires that when making an acquisition that the acquiring company disclose what its condensed income statement would look like if the acquisition occurred at the beginning of a reporting period. This helps investors distinguish between internal and external growth.

- Oddly, the 1Q’11 numbers were substantially revised in 2Q’11, without explanation. We estimate that 1Q’11 EPS were boosted $0.12/share. In other words, numbers aren’t adding up. (This is calculated by comparing YTD earnings per share with the previous quarter). All tables can be clicked to enlarge.

|

| GMCR 1Q’11 Proforma earnings |

|

| GMCR 2Q’11 Proforma earnings, including year-to-date data. |

Key Difference #2

SodaStream’s internal, or organic growth, is better than GMCR’s. Other than an acquisition of assets from a bankrupt company in the Nordic region that got hit with the financial crises, all of SodaStream’s growth is internal. For example, during FY 1Q’11, both operating income and adjusted EBITDA doubled while revenues grew 50% (all without acquisitions!).

|

| Note: company uses the Euro as a reporting currency. Source: SodaStream |

Key Difference #3

SodaStream’s financial statements are significantly more transparent compared to GMCR. In order for analysts to accurately measure and forecast the company’s performance several key metrics are necessary including:

- Unit sales of Keurig brewers

- Coffee pricing

- Unit sales of K-cups

During 1Q’11, GMCR’s management decided to stop disclosing K-cup data, leaving investors in the dark.

In this regard, SodaStream is excellent. The company not only provides data points in its conference calls, but significant data about its business model is disclosed in its government filings. This allows some comfort when analyzing trends, as SodaStream analysts have to reconcile two different businesses:

- Soda Makers: aka, the razor

- Consummables (CO2 bottles, flavors): aka, the razor-blades

- Note 1 below is a small distribution business of Brita filters and related products

|

| Note: Soda Makers and Consumables data sourced from SodaStream |

In the above table, note that CO2 cylinders are also included under Soda Makers (first line) as the company typically includes one or two CO2 cylinders in its “Starter Kit” Soda-makers. The Consumables line includes both the CO2 cylinders as well as Flavored Syrups, of which the company discloses in separate text. Unit sales are also disclosed on a quarterly basis (not in the above table).

Key Difference #4

Market share, revenue and earnings potential are all greater for SodaStream than Green Mountain Coffee Roasters. With an $11Bn market cap and nearly $2.5Bn in expected revenue for FY’11, the company is quickly reaching its asset-size capacity. GMCR is expecting 82%-87% reported revenue growth for FY’11. We are not saying that the potential is not there for GMCR, but with a U.S. market share of 35%-45% for household coffee makers (depending on whom you ask, or trust..) it will be difficult to continue rapidly gaining share. At some point, GMCR will effectively become the market, and it’s growth will be limited by the LT growth of the home consumer coffee market. This growth is likely to be 5%, according to Moody’s.

It is difficult to ascertain the addressable market for GMCR, but it is likely below $9Bn (U.S. At-Home market). This author has seen global numbers for single-serve coffee that were no higher than $4Bn. However, NPD Group notes that GMCR has only 8-9% of the total number of U.S. coffee drinking households. However, this percentage needs to be distinguished from the addressable market which we view as far smaller (see $ amounts above).

For comparison, SodaStream’s beverage market is slow-growing (see chart below) but the total market size is absolutely huge. According to Datamonitor, the global off-premise soft drink and sparkling water market generated $216Bn and $34Bn respectively in 2009.

Note that SodaStream is a global company with products selling in 41 countries. Given that SodaStream’s soda makers are unique products that some consumers will never buy, and given market control by Coca Cola, etc., market share potential (in % terms) is likely limited to 5%-15%. So far, SodaStream’s highest penetration has been in Sweden where its share is 21%.

Taking a conservative share percentage of 6% yields an addressable market size of $15Bn (includes soda + sparkling water). This compares with SODA’s FY’10 revenues of just $227.8MM (converted from Euros). In global market share terms, this equates to just 1.5% of the addressable marekt. It is difficult to ascertain SODA’s U.S. market share, it’s most important market. However, management believes it is negligible (~ 0.25% of the total market). Hence, the potential for SodaStream is huge, so long as the company executes well.

Disclosure: the author is long GMCR, SODA