Many socially responsible funds advertise SRI as a way to increase returns on investment (ROI). Even the United Nations, under the UN Principles for Responsible Investment have said that:

Several American studies we have read seem to establish that SRI funds perform better than conventional indices, albeit ever slightly. The most popular index, the KLD Social 400, is an index launched in 1990 to invest in U.S. based SRI type companies using both Negative and Positive Screening. This index indeed has had a good long-term outperformance. However, after reviewing several studies, we believe performance results are still not clear-cut. Why?…well, we’ll just touch on a few…

- Survivor basis: Share price histories of corporations that are bankrupt may not have been used in studies. This upwardly skews performance.

- The “Chicken & Egg” effect: It is not clear that companies with high ESG are that way because they can afford to do good, or that they did good first.

- Availability bias: The majority of studies are conducted by students, and asset managers. It is doubtful that they would publish studies that show weak SRI performance, as most authors are trying to “make a case” for SRI.

- There are few standardized definitions of ESG; studies tend to look at different factors. For example, some studies focus on the outperformance of companies in the Fortune 100 Best Companies to Work for list. However, many SRI analysts do not consider such companies as necessarily highly ranked in ESG.

Could performance perceptions be cultural?

Further, there is a positive bias among those researchers (many of them American) that are conducting the studies. However, such bias may be cultural. According to a Novethic study entitled ESG Perceptions and Integration Practices, French do not believe that ESG will increase fund returns. In fact none (0% of those surveyed) believed that SRI would improve performance. The most popular survey answer, at 59%, was “Contributing to bringing about a more sustainable business model” with 30% looking to “Manage long-term risks.” In other words, French utilize SRI because it’s the right thing to do, not because they expect to receive handsome rewards. For comparison, a large 57% of surveyed asset managers in the United Kingdom believed SRI could improve performance. (We are using the UK as a substitute for the United States, which was not included in the survey.)

Does French performance data support their beliefs?

We have reviewed three (related) French SRI studies on investment performance. All three studies were conducted by the EDHEC-Risk Institute. École des Hautes Études Commerciales du Nord (the long name) is one of the top business schools in France (est. 1906). Our favored study is the report entitled French Corporate Social Responsibility: Which Dimension Pays more? (Published June 2010).

Its results stated that “At the aggregate level, i.e, when all events are considered simultaneously, it appears that CSR has a positive (0.05%) but not statistically significant impact on a company’s stock returns.”

The short answer to the headline question above, is that Yes, French performance data do support their belief that SRI does not increase performance.

But lifting the rock reveals some interesting findings…

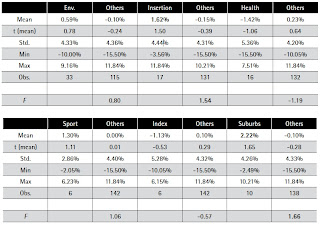

So why do we like this study you ask? Well, it gives us hope. The purpose of this study was to separate the dimensions (factors) of CSR to examine which particular ones were relevant. In other words, what would the results look like if we isolated the “C” for example, from CSR. The study actually examines 6 different dimensions, and four of them yielded an average positive cumulative abnormal return that was statistically significant.

The best were Environment (the “E” in ESG) and what the report called Insertion, which is helping young and handicapped people in their careers (in other words, the “S” in ESG). Suburbs also performed well, which is related to helping local communities, and is also the “S” from ESG. We note this correlates with the outperformance of SRI investments using the Fortune 100 Best Companies to Work for list, which is more related to the “S” than the other dimensions examined in the French study. (Note: As a reminder, SRI refers to the act of investing in companies that utilize CSR/Corporate Social Responsibility and ESG/Environmental Social Governance. SRI is from the investors’ perspective, while the other two are from the corporation’s view.)

|

| Source: EDHEC, June 2010 |

Two additional French studies

The other two studies (one is an update) were based on the original EDHEC paper written in 2008. The first study used the Fama-French three-factor model for a six-year period ending in 2007. The latest study’s (September 2010) goal was to update the latter study to examine the effects of the Financial Crises on socially responsible investments. This study examined 62 funds over a fairly long period for SRI (8 years). The sample was split into two types of funds: Traditional SRI, which is mostly best-in-class funds and a Green group of funds. Note that Negative funds that screen out for sin-stocks are not as popular in Europe as in the States, and thus, were not examined. The Green group included funds that are related to the environment such as renewable energy, water preservation or climate change.

Did the Financial Crises affect Socially Responsible Investments?

The results of the September 2010 update (The Performance of SRI and Sustainable Development in France: An Update after the Financial Crises) were not what investors were hoping for. None (zero) of the 62 funds of the sample produced both positive and statistically significant alpha. In other words, after adjusting for risk and the security market line, SRI funds did not outperform conventional indices. The study appears very comprehensive as it not only looks at the conventional Fama-French factors (which are similar to Beta) but also examines and compares the VaR (Volatility at Risk) for the funds. It notes that SRI indices exhibit both higher standard deviation (volatility) and VaR than conventional indices.

Side-note on the studies’ use of Green Funds. Firstly, Green Funds should be examined with a long time period (perhaps 20 years if possible) since their look-back periods may be too short as these funds may be leveraged to energy prices and solar subsidies and such are cyclical in nature. Secondly, we note that certain investments in Green Funds may not be considered socially responsible by SRI aficionados.

The study highlighted Green Funds, of which had better returns than traditional SRI funds with a slightly higher risk. However, this is not what we have experienced in the United States. Ethanol and Solar companies, for example, have had extremely volatile stock prices over the last 5 years, though we cannot provide our readers specific alphas at this time.

Lastly, the study analyzed the effects of the U.S. led Financial Crises onto SRI funds. The general conclusion was that SRI funds were not spared the increase of extreme risks during the crises.

Our Conclusion: It appears that the French are no better and no worse at socially responsible investing compared to the Americans. However, the French culture, which includes their historically more intense reliance on statistics, produces a more realistic conclusion. We are yet to be convinced that SRI improves investment performance given all the extra work and analysis involved (and higher volatilities). This “extra work” results in higher management fees to investors (i.e., lower net returns). Future studies will no doubt answer this question one day…