CHC Group: This Bird is Flying too Close to the Sun

I first noticed CHC Group (NYSE: HELI) in 2014 when I was examining the Energy Industry. As a former industry analyst I thought that its business of flying workers back & forth to offshore oil rigs was highly sensitive to oil prices, despite being classified as a transportation company. HELI has the world’s largest helicopter fleet (231) serving several geographic locations, of which over 81% of FY’15 (ended 4/15) revenues are to the energy end-market (i.e, E&P companies).

|

| Source: CHC Group |

What caught my eye was the company’s sloppy-looking financials and its huge 10k report. While the left-brain side is important for company analysis, it is the right-brain that makes investing more of an art than science!

The chart below shows the yearly change in SPDR Oil Service ETF (XES) versus CHC Group (HELI). Clearly they are correlated. Further, CHC Group performed much worse than its peer group since Jan’15 due to its high financial leverage.

|

| Courtesy of GoogleFinance |

After seeing CHC Group’s recent stock price trading under $1.00, I thought why bother writing about this. It’s too late! But then I remembered all the soured investments in penny-stocks I had made as a novice trader. At that time, I thought these volatile issues just needed to go up 50 cents and I’d sell. However, investing in low-priced stocks is a fast-lane to the Poor-House.

This article is for all my fellow investors that have no access to brokerage-reports, not even Seeking Alpha has written much on HELI. So then, maybe this is my social responsibility to investors!

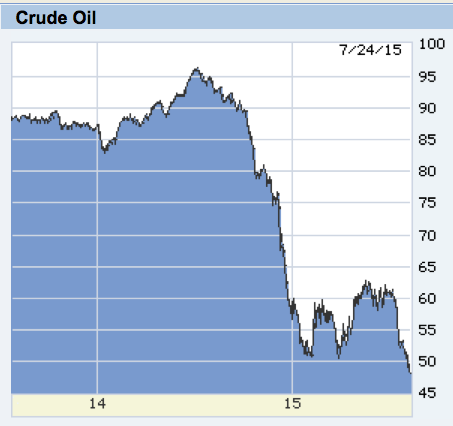

We all know that commodity prices are weak and oil is now trading below $50/barrel. I’m a big believer of Contrarian Investing. However folks – playing a risky small company is not the way to do it – Exchange Traded Funds are.

|

| Source: WSJ Market Data Center |

Business Outlook:

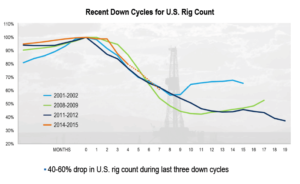

CHC Group’s business is closely tied to worldwide E&P budgets, of which is correlated with oil prices and the number of drilling rigs. While CHC’s business is most closely tied to offshore global drilling, the chart below (from Baker Hughes) is quite useful as it shows the number of months before the industry actually hits bottom.

Below I will briefly list the main reasons why investors should avoid CHC Group. Essentially, this is a small company bleeding cash that has a highly leveraged balance sheet. If existing trends continue, the company will likely go into bankruptcy proceedings, or undergo a debt-recapitalization in which a private equity company such as Clayton, Dublier & Rice (CDR) takes over the company. Should this happen, equity holdes will be wiped-out.

- CHC Group has never earned a profit going back at least 5 years. If the company cannot earn dollars during a healthy energy market, it will surely continue losing money in the current weak energy environment. CHC’s customers are large well-funded exploration companies. While they’re good on their IOUs, they however, have large bargaining leverage with CHC Group and have already begun negotiating down the rates they give to CHC, according to the 4Q’15 conference call.

- The company still lost money even after excluding special and non-recurring items (which it may have presented to make earnings look better than they really were).

- Interest Expense and Fixed Charges (including lease, and pension payments) are too high for the company to support going forward. While management retired a chunk of debt ($320mm) in FY’15 that will reduce interest expense about $30mm/year, interest and leasing costs may remain too high for EBITDA to cover. The problem (see reporting issue below) is that the company’s reported EBITDA is not a true representation of cash flow or even EBITDA.

Reporting Issues:

- I have never seen a company with so many versions of adjusted financials. Companies typically report GAAP financials, meaning a standard set of accounting guidelines that can be compared with other companies. They sometimes add EBITDA to their reporting statements, especially if the company is new and growing rapidly (such as Twitter) or if they have a large base of debt and bond investors. However, CHC Group had to add an “R” (i.e., rent) to EBITDA because of a large number of leases, and that is reasonable. But they also show an Adjusted EBITDA, and wait, it gets better, an Adjusted EBITDA excluding Special Items.

- There are numerous adjustments (i.e., costs) the company makes, I believe, mostly to boost its reported EBITDA. Certain of these should probably be excluded, that is, reduce EBITDA since they are cash expenses. These expenses may include costs due to management turnover, cash restructuring costs & severance

- CHC Group’s Press Releases to shareholders are not clear, and frankly, misleading. The first bullet point on its 4Q’15 earnings press release says that, “Fiscal 2015 revenue down 3% and Adjusted EBITDAR excluding special items down 2%”. This alludes to a company who’s business condition is slightly worse than last year, which is clearly not the case.

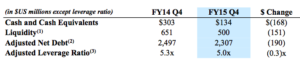

- The company’s Balance Sheet shows debt of $1.2Bn. However, the company’s huge number of leases increases its OBS (Off Balance Sheet) debt. The company provides a reconciliation of Adjusted Net Debt, which it values at $2.3bn as of FY’15 (April’15)

- HELI’s heavy dependence on leasing as well as its new $145mm Asset Backed Loan (ABL) significantly reduces transparency. CHC will use its ABL line to outright buy new helicopters while returning those helicopters that come-off lease. This will affect how income is presented including their timing. Furthermore, it is uncertain what assumptions management used to attain the net present value of its leases. For example, it could lower its adjusted debt by simply increasing the rate it utilizes to calculate the present value (loan equivalent) of its leases.

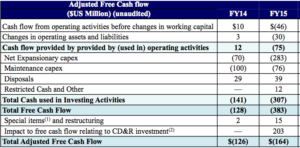

- Free Cash Flow: I typically examine GAAP free cash flow since this is less easily manipulated. I take operating cash flow then subtract capital expenditures (CapEx). It’s very easy. However, even here, the company adds a confusing version of its “Total Adjusted Free Cash Flow”. The company makes a bunch of adjustments, of which, the net effect is to sharply boost FCF to a still negative $164mm.

- In the 4Q’15 conference call, outgoing CFO Joan Hooper refused to answer questions on its future outlook saying it would not give any guidance of any kind. Typically, when a company readjusts its business via layoffs etc., it gives a proforma outlook of what its cost-structure will look like. The CFO also refused to give any guidance on expected revenues, etc. for the coming year.

- I found two small errors in the 4Q’15 powerpoint presentation, again something I have never seen before. It gives one the feeling that the company doesn’t dedicate enough resources to its business and has poor reporting & governance.

Balance Sheet:

- The company has a very leveraged *balance sheet (*including the loan equivalent of its future lease payments).

- Though the company has already written-off $0.4bn in Goodwill, I believe further assets may be written off including $0.2bn in Intangible Assets as well as property plant & equip and a small amount of deferred tax assets (as it’s unlikely the company will make money any time soon).

- While management says they have $3.1bn in Fleet Value of 231 helicopters. Note that it only owns about 20-25% of them, including old helicopters, as per the conference call. This equates to about $0.6bn. Recall that is exactly the amount of the recent Preferred Share offering to Clayton, Dublier & Rice. So before equity investors see anything in a bankruptcy, the secured debt holders, ABL holders, and preferred debt holders would have to get their slice. In other words, equity holders will receive nothing for their shares.

- Despite the above mentioned $0.6bn that boosted the balance sheet, shareholder’s equity is in deficit by $0.4bn due to net losses and the $0.6bn in asset impairments. In other words, there is a Negative book value on CHC Group’s shares!

- While the company highlights that it has *$500mm in liquidity (FY’15) notice that it has just $134mm in cash and that it is burning about $100mm per quarter. (*There’s another $145mm in liquidity from the ABL booked after the fiscal year ended.)

- Again, the company highlights its own version of FCF, so it was difficult for me to ascertain cash-burn. Readers should note that a company can reorganize through a prepackaged bankruptcy even with a moderate level of cash.

Management & Governance:

- NYSE (The NY Stock Exchange) categorizes CHC Helicopter as a “controlled company”and the majority of voting power is held with First Reserve and CDR. CHC’s board is not independent and the company is exempt from governance rules. In other words, shareholder protections are weak.

- CHC is incorporated in the Cayman Islands, which again weakens shareholder protections.

- Executive turnover is the highest I have ever seen. Within the last year or so, there has been a new President & CEO, Chief Operating Officer, President of the Heli-One subsidiary, SVP of Human Resources and General Counsel & Chief Administrative Officer. Management needs time to get a grip on the company’s business before it is able to assess and execute an action plan.

So what’s CHC Group worth?

Given that the firm does not pay dividends, hasn’t made money, and has negative equity, an investor or potential buyer cannot value the company using conventional benchmarks such as P/E ratio, Price-book ratio, or dividend discount model. A discounted FCF model may be used but the company doesn’t have positive cash flow so that would be based entirely on assumptions.

So we come down to Enterprise Value (EV). Even here, one cannot simply use reported debt of $1.2bn as there is another $1.2bn or so of OBS debt. After including the above, adding preferred stock and netting against cash, CHC’s Enterprise Value is $3bn. Buyers typically pay a multiple of EV, however, in this case a potential buyer would likely wait for a distressed situation, then pay a low multiple given that the debt would be trading at a low market value.

Conclusion:

While the average investor may not appreciate every detail of this article, my goal was to protect you from making a hasty decision. There are many investments as well as turnaround situations that have much lower risk and higher returns.

Penny stocks are for the birds. On 7/23/15, the NYSE notified CHC Group that they have 6 months to bring their shares over $1.00 else face a delisting.

Disclosure: The author has no position in CHC Group (HELI) and has not received any direct or indirect compensation for this article.

Investors are getting roasted with JVA

However, we strongly believe that JVA’s shares are overpriced (P/E: 31x) and its business risks are High…Not a good Brew! Below are our Top reasons to avoid these shares:

|

| Coffee Futures (KCU11) |

The Income Statements below are for FY’09, FY’10 and 2Q’11. They include adjustments (i.e, hedging profits are taken out of reported numbers). FY’09 adjusted numbers also exclude a non-recurring gain of $2.1mm. This results in 36% and 73% lower EPS for FY’10 and FY’09, respectively. 2Q’11 adjustments resulted in 69% lower EPS. Under the “% Change” column, is noted how the adjustments affect the Balance Sheet and Cash Flow Statements.

In bad times (i.e, when management makes “wrong-way” bets) reported earnings could decrease significantly (as in the most recent quarter, see below).

C) JVA director Daniel Dwyer, is a coffee trader at Rothfos Corporation- a coffee bean supplier. Mr. Dwyer is also responsible for a large account between the two companies. Refer to Item 13 of Form 10-K/A for FY’10 for more information.

Conclusion:

We have not seen evidence JVA is using aggressive accounting or misusing its relationships. We also believe the company is correctly accounting for its hedging program as per IAS 39. However, they’re just too many risks (e.g., dependence on GMCR) to justify its high share price

Disclosure: The author has no investment position in JVA (short or long). The author does not receive any monetary or implicit dollar benefit from this article.

SODASTREAM…Not your grandfather’s Green Mtn. Coffee

SodaStream International Ltd is an Israeli company that makes and sells home beverage machines. These portable machines typically make flavored sodas out of ordinary tap water, or just seltzer/sparkling water at the consumers’ preference. In order to make a flavored drink such as a cola, SodaStream sells these products:

- Soda Makers (Beverage Machines): to make the drinks

- CO2 refills: which make the drinks fizzy

- Flavored Syrups such as root beer, colas

- Bottles which the Soda Makers fill the soda into

SodaStream is not your grandfather’s Green Mtn. Coffee Roasters – it’s better than that! How then….?

Key Difference # 1

Harking back a decade ago, GMCR was showing real earnings – more recent earnings are suspect. It reported steady revenues and earnings growth, of which was organic (i.e., internal, without acquisitions). Now, I’m not quite sure what their earnings really are, or how rapidly the company is really growing given the huge acquisitions skewing reported growth. For additional information, please refer to this website’s article on Green Mountain, which essentially alludes to the company’s deceptive practices of presenting earnings.

- Proforma Revenue growth (+54%) was below reported revenue growth (+67%). See table below for figures.

- Note: GMCR also focuses on Non-GAAP numbers when presenting to investors, of which excludes several items including cash litigation expenses. These Non-GAAP earnings are significantly higher than reported earnings.

The tables below present GMCR’s proforma condensed income statements for FY 1Q’11 and 2Q’11 (including YTD). The Securities and Exchange Commission’s Rule 210.11-02 requires that when making an acquisition that the acquiring company disclose what its condensed income statement would look like if the acquisition occurred at the beginning of a reporting period. This helps investors distinguish between internal and external growth.

- Oddly, the 1Q’11 numbers were substantially revised in 2Q’11, without explanation. We estimate that 1Q’11 EPS were boosted $0.12/share. In other words, numbers aren’t adding up. (This is calculated by comparing YTD earnings per share with the previous quarter). All tables can be clicked to enlarge.

|

| GMCR 1Q’11 Proforma earnings |

|

| GMCR 2Q’11 Proforma earnings, including year-to-date data. |

Key Difference #2

SodaStream’s internal, or organic growth, is better than GMCR’s. Other than an acquisition of assets from a bankrupt company in the Nordic region that got hit with the financial crises, all of SodaStream’s growth is internal. For example, during FY 1Q’11, both operating income and adjusted EBITDA doubled while revenues grew 50% (all without acquisitions!).

|

| Note: company uses the Euro as a reporting currency. Source: SodaStream |

Key Difference #3

SodaStream’s financial statements are significantly more transparent compared to GMCR. In order for analysts to accurately measure and forecast the company’s performance several key metrics are necessary including:

- Unit sales of Keurig brewers

- Coffee pricing

- Unit sales of K-cups

In this regard, SodaStream is excellent. The company not only provides data points in its conference calls, but significant data about its business model is disclosed in its government filings. This allows some comfort when analyzing trends, as SodaStream analysts have to reconcile two different businesses:

- Soda Makers: aka, the razor

- Consummables (CO2 bottles, flavors): aka, the razor-blades

- Note 1 below is a small distribution business of Brita filters and related products

|

| Note: Soda Makers and Consumables data sourced from SodaStream |

In the above table, note that CO2 cylinders are also included under Soda Makers (first line) as the company typically includes one or two CO2 cylinders in its “Starter Kit” Soda-makers. The Consumables line includes both the CO2 cylinders as well as Flavored Syrups, of which the company discloses in separate text. Unit sales are also disclosed on a quarterly basis (not in the above table).

Key Difference #4

Market share, revenue and earnings potential are all greater for SodaStream than Green Mountain Coffee Roasters. With an $11Bn market cap and nearly $2.5Bn in expected revenue for FY’11, the company is quickly reaching its asset-size capacity. GMCR is expecting 82%-87% reported revenue growth for FY’11. We are not saying that the potential is not there for GMCR, but with a U.S. market share of 35%-45% for household coffee makers (depending on whom you ask, or trust..) it will be difficult to continue rapidly gaining share. At some point, GMCR will effectively become the market, and it’s growth will be limited by the LT growth of the home consumer coffee market. This growth is likely to be 5%, according to Moody’s.

It is difficult to ascertain the addressable market for GMCR, but it is likely below $9Bn (U.S. At-Home market). This author has seen global numbers for single-serve coffee that were no higher than $4Bn. However, NPD Group notes that GMCR has only 8-9% of the total number of U.S. coffee drinking households. However, this percentage needs to be distinguished from the addressable market which we view as far smaller (see $ amounts above).

For comparison, SodaStream’s beverage market is slow-growing (see chart below) but the total market size is absolutely huge. According to Datamonitor, the global off-premise soft drink and sparkling water market generated $216Bn and $34Bn respectively in 2009.

Note that SodaStream is a global company with products selling in 41 countries. Given that SodaStream’s soda makers are unique products that some consumers will never buy, and given market control by Coca Cola, etc., market share potential (in % terms) is likely limited to 5%-15%. So far, SodaStream’s highest penetration has been in Sweden where its share is 21%.

Taking a conservative share percentage of 6% yields an addressable market size of $15Bn (includes soda + sparkling water). This compares with SODA’s FY’10 revenues of just $227.8MM (converted from Euros). In global market share terms, this equates to just 1.5% of the addressable marekt. It is difficult to ascertain SODA’s U.S. market share, it’s most important market. However, management believes it is negligible (~ 0.25% of the total market). Hence, the potential for SodaStream is huge, so long as the company executes well.

Disclosure: the author is long GMCR, SODA