Background:On January 14th, 2011, S&P’s European downgrade was the “shot heard round the world.” And still, Apple’s Asian experience managed to climb to the top of the

Wall Street Journal’s Business & Finance page.

|

| Apple, Inc. |

What’s going on?

Well, like Google, Apple’s finding itself caught between the promises and perils of doing business in Asia. Apple had to temporarily halt sales of its new iPhone after a disturbing wrangling outside its flagship store in Beijing. Migrant workers hired by “scalpers” started pelting the stores with eggs and getting unruly after the company sold out of phones. (While Google has to deal with Chinese censorship, Apple has its own Chinese problem – the authorities forced it to disable iPhone’s Wi-Fi capabilities.)

Supplier Working Conditions Report:

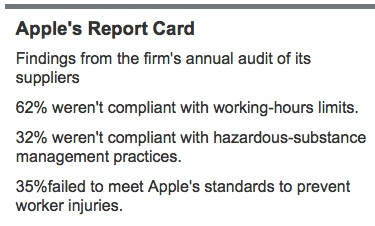

The other news of the day, was the release of Apple’s Supplier Responsibility Report) after a tad of nudging by activists. The urgency to release the report grew after employees at its Foxconn supplier threatened mass-suicide if working conditions hadn’t improved.

As an American, I think it’s difficult for us to understand just how inhumane these conditions are. We think in general terms (e.g., “Sweatshops”) and how some factories hire under-aged workers. But these kids aren’t working 10 minutes for ice-cream. In reality, it’s closer to legalized slavery.

It is in Apple’s best interest to put its “best foot forward” by pointing towards progress at its suppliers. And they do. However, after going to the source and reading the Supplier Conditions report, I tell you it’s DISTURBING. It’s considered a GOOD thing if the average worker spends less than 60 hours a week working (and rec 1 day of rest after 7 days). Apple identified 110 facilities where this has been a continuing problem.

|

| Source: Apple Inc., WSJ |

Workers must also deal with combustible materials, which last year resulted in explosions at Foxconn (making headline news). Though, overall, the area with the lowest ratings was management information systems. This may not sound important, however, these systems allow suppliers to execute corrective actions and hold managers accountable.

|

| source: Apple Computer |

At what cost is ESG Compliance?

I researched the costs involved with making a company fully “ESG compliant” – from “cradle-to-grave.” It turns out, there is no comprehensive data on the subject. However, it’s my sense that there is a more than negligible cost. Maybe the question really should be, “Is there a Financial Reward for ESG investments?”

Who receives benefits from ESG Compliance?

Apple’s suppliers clearly pay a cost for ESG compliance. In fact, suppliers that were using indentured labor have already paid nearly $7m to employees after Apple’s audits (Source). Apple also pays for ESG compliance as the company reports (and reduces) its yearly Carbon Footprint from the design to the recycling stage. However, it is Apple that receives the benefits because it is its name on the product and due to its strong market position.

Apple’s market position allows it to reap from ESG efforts.

Using Porter’s 5 forces framework of Industry Structure, one can easily see that Apple is in a venerable position as it has huge Bargaining power against its Suppliers, and its sometimes cultish customers (there is only one iPhone). And despite Android, the threat to its ecosystem is minimal given its closed nature. According to several white papers, ESG-centric companies receive several benefits including higher valuations, better profit margins (see graph below) and lower costs of capital. This is because they’re less subject to accounting issues and litigation, and tend to have more capable management. See link for additional information.

|

| source: SustainabilityAdvantage.com |

Conclusion:

Apple’s Steve Jobs has been known for being stingy with philanthropy and the company historically has been somewhat of a laggard as a Green Citizen (Source: ClimateCounts.org). But it’s not known whether Jobs may have given anonymously or left these decisions to his wife/estate. What is apparent is that the new CEO Tim Cook (previous COO) knows factories.

Now that Jobs’ powerful personality is gone, Cook will be able to provide a more nurturing face to the world. The Supplier report was a good step in this direction given that Chinese authorities would rather keep such disclosures out of the public eye!

Disclosure: the author is long AAPL, and wrote this article on a Macbook!

Editor’s Note: just to be fair, the supplier issues are an industry-wide problem, and not just an issue between AAPL and Foxconn, etc.